Most people don't have a congruent conception of money. In other words, they don't fully understand what money is and how it works. This is not an opinion. My team and I surveyed more than 300 people to discover how money is being perceived by professionals of varying experience and educational backgrounds and to what extent their conception is congruent with reality. Why is this important? Because to understand the modern economy, you must first understand money. Without a congruent conception of money, you may find that the conversations you have with yourself about money unconsciously play a role in your ability, or inability, to generate wealth and prosperity.

Most people are unaware of the ramifications of an incongruent conception of money. Since money is the medium we all use to exchange value in our society, we all need it to acquire the many things we desire in life. However, when it comes to money matters, things are not always as they seem. In this article, I discuss what money is, how effective entrepreneurs, investors and the wealthy relate to money and why they generally have a more authentic and congruent conception of money than other people, the difference between money and currency, and alternative ways of thinking in terms of how to make money. It will address the age-old question of why some people generate abundant wealth while others continually struggle to pay the bills and put food on the table.

While the subject of this article may seem simplistic or obvious to some, my studies and extensive experience working with professionals and businesses have highlighted a common lack of awareness around the reality of money. The purpose of this article is to shed light on these misconceptions in the hope that this newfound awareness may ultimately lead to a paradigm shift in terms of the way you think about money and your relationship with it. Furthermore, it highlights why it pays (literally) to develop an entrepreneurial conception of and relationship with money.

We human beings have created an economy in which, to a large degree, our collective shadow – the dysfunctional and troubled parts of us – is running the show. In today’s economy, we are misusing nature and its resources, producing toxic products, conducting predatory lending, creating insurance and banking loan scams and promoting the spending of money we don’t own on items we don’t need through credit card purchases while others capitalise on that. We regard all of this as ‘normal’ based on an assumption that if the banks, for example, do it, then it must be an acceptable practice. This is not a moralistic standpoint. It’s looking at the reality behind a situation that isn’t workable in a sustainable, long-term way.

Before we zoom in further on the money conversation, let me bring your attention to a simple truth: we all have a unique combination of perceptions, a perception being how we know something to be. In my book, BEING, I refer to the collection of these unique perceptions as our ‘Web of Perceptions’. Let me explain. Whenever you come across a new object, concept or idea, you form a perception of it. Your perceptions are shaped in many ways, including your upbringing, the environment in which you were raised, your culture, religion, the norms of society, your education, the schools of thought and leaders you follow and your contemplation and experience of life. The more congruent your perception of a matter is with reality, the greater the chance of shaping an authentic conception of it. This is when you can relate your perception of a matter to your own life. The more authentic your conception of reality, the more equipped you are to deal with any matter, including life’s inevitable challenges. It will enable you to make more effective decisions and take more effective actions, resulting in an increased probability of hitting the targets you set for yourself in life. The following excerpt from my book provides a tangible example of what can happen when we have a perception that is incongruent with reality:

In my company, my teams and I see many enthusiastic and ambitious first-time tech entrepreneurs who come to us actively seeking an investor, even though they are a long way off being investment-ready. Just because they have come up with a potentially brilliant idea, they assume it automatically entitles them to raise a million dollars through an external investor. This perception is commonly the result of reading about the overnight success stories of tech startups on social media who claim to have raised funds simply by sending a few cold emails. So, they assume, ‘If they can do it, so can I!’

The above highlights a common misconception about raising funds for a business venture. If your conception of money is incongruent with reality, similar problems arise. It will greatly influence your decisions around money and wealth, which will ultimately impact your fulfilment and prosperity in life.

What is money?

Given the worth of money is reliant on a promise, it is highly dependent on the individuals and systems making the promise. Therefore, the integrity of those individuals holding the power matters.

In simple terms, money is a tool for trading your time and work and a storage vessel for your economic energy until you choose to release it in exchange for goods and services. Historically, money was a commodity that had an intrinsic value derived from the materials of which it was made, like gold and silver. Today we have paper money. However, the paper itself holds no value. Like magic, a worthless piece of paper is printed as a banknote and suddenly it is worth $100! Fiat money (government-issued currency not backed by a commodity like gold) is a promise from a government or central bank that the currency is capable of being exchanged for its assumed value in goods or services. If the government or central bank doesn’t come good on its promise, the money is nothing more than a worthless piece of paper. However, when we look at the reality of a national currency, that promise doesn't hold its value due to inflation. This means you are essentially acquiring something that will not only lose its value over time but on which you will also be paying various taxes for the privilege of possessing it. Ironic, isn’t it?

Given the worth of money is reliant on a promise, it is highly dependent on the individuals and systems making the promise. Therefore, the integrity of those individuals holding the power matters, including their compassion, care, commitment, responsibility, authenticity and effectiveness in determining the policies around the national currency. In other words, it hinges on how they are being. Would you agree that this is something we should all be aware of and care deeply about? It is also worth noting that it’s not just about the policies or the politicians we elect; it’s also about our contribution as citizens and active members playing our role in the economy. For example, if you are a farmer producing goods for export, you are inherently contributing to the GDP of the nation, and that has an impact on the value of the nation's currency.

Money and currency are not the same

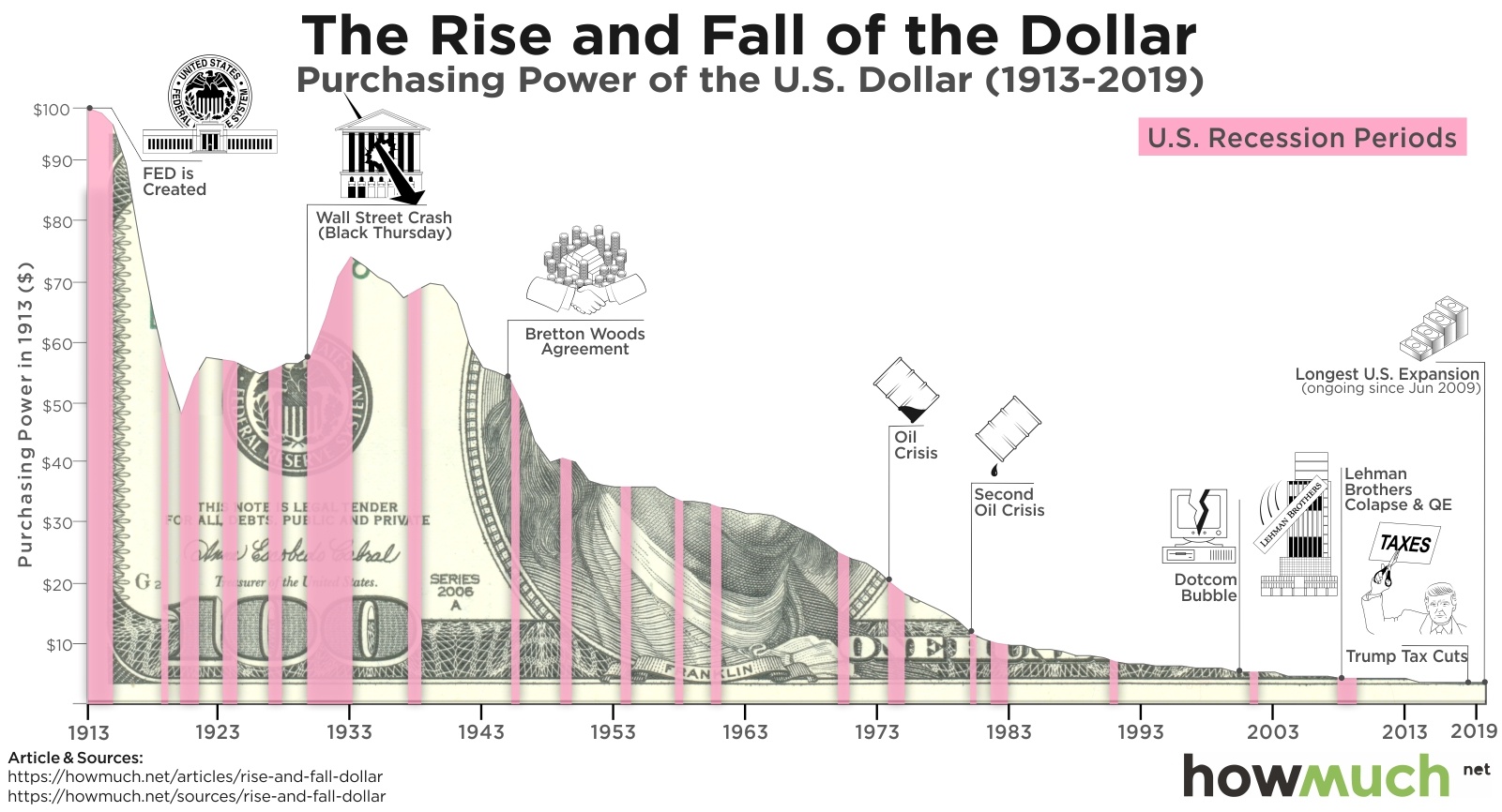

Very few currencies today are commodity currencies. Today’s national currencies are tools used by governments to diminish our purchasing power. Our purchasing power slowly declines whenever more notes are printed by the nation’s central bank. This is a phenomenon called ‘quantitative easing’, an economic monetary policy intended to lower interest rates and increase the supply of money. In the US, for example, 94% of the value of the dollar was lost within 108 years. So, $100 in 1913 would be worth less than $4 today.

Visualizing the Purchasing Power of the Dollar Over the Last Century

Monetary systems are not hidden, but they are complex, and this contributes to the confusion and lack of awareness around them. Also contributing to the confusion are those who intentionally create deceptions around these complex systems, adding yet another layer that can get in the way of shaping a congruent perception of money and how it works. My aim is to support you to shape a perception of money that is congruent with reality through greater awareness. Only then can you relate it to your life (conception) and the matters you care about.

What is a commodity?

Once you start perceiving money as a commodity, which is an authentic way to perceive it, you will learn that, like tomatoes, it can rot.

In economics, a commodity has two simultaneous values: Use Value and Exchange Value. For example, tomatoes are commodities because they can be consumed (Use Value) and exchanged for money (Exchange Value), such as when the farmer sells tomatoes to the greengrocer and the greengrocer on-sells them to consumers. However, the air we breathe is not a commodity. While it has Use Value, it does not have Exchange Value. You can’t trade air.

Money is also a commodity. Money has Use Value; you use it to buy what you need or want, let's say some tomatoes for your salad. And it also has Exchange Value; you exchange it for the tomatoes you just purchased and the grocery store owner exchanged the tomatoes for your money. Not only is money a commodity, but it is a unique commodity in that its Use Value is equivalent to its Exchange Value. When money is being used, it is being exchanged and when it is being exchanged, it is being used. Why does this matter? Because once you start perceiving money as a commodity, which is an authentic way to perceive it, you will learn that, like tomatoes, it can rot. Moreover, because money is a commodity, the supply and demand rule applies to it, just as it does to other commodities, like tomatoes. When there is an oversupply of tomatoes on the market, the value of each unit of tomato falls. On the contrary, when there's a shortage of tomatoes, the market value increases. In other words, people are willing to pay more for it. Similarly, the value of money depreciates if you leave it sitting idle somewhere, such as in a bank account. Inflation will cause the value of your money to depreciate. Ironically, the money you ‘saved’ is not being saved at all! The rich understand this principle, which is why they choose to invest their money and turn it into assets rather than leave it sitting idle in a bank account. They make their money work for them. In some of the world’s financially disadvantaged nations, on the other hand, less than 3% of the population invests their money. I discuss this point in my book, BEING, under the heading of ‘Web of Perceptions’. Below is an excerpt on this point.

The perception that one needs to save money but not invest becomes a behavioural pattern [in disadvantaged nations], which leads to an inability to grow financially as individuals. Furthermore, when the vast majority of the population adopts the same mindset, it means that collectively as a nation, money isn’t being injected back into the economy. And we all know the ramifications to the national economy when that happens. I am not trying to give you a lesson in economics here. My point is that the collective perception of money in those relatively poor countries is incongruent with the reality of money. Therefore, their economy suffers and, consequently, almost everyone’s life suffers.

Work – more specifically, the work performed by an individual – is yet another commodity. Work has Use Value in the sense that an employer or a client is using an individual's work. And it has Exchange Value because the individual exchanges their work for money. In other words, they are trading their service/work for money. Like other commodities, what the market (the people in need) are willing to pay for your work largely defines your work’s value. Many people think they are doomed to trade their time for money to pay the bills and put food on the table forever, like a hamster on a wheel. However, if you choose to rely on nothing more than the income you bring home as an employee or a sole trader for the rest of your working life without investing it once you have generated sufficient cash flow, you will be limited to the hours you can work and the value you bring to the organisation/clients you work for. This is true even if you are an extremely well-paid employee or successful sole trader.

What’s the alternative?

If your goal is to be a billionaire, you have to be willing to make other people millionaires.

An alternative to trading your time for money by working as an employee or a sole trader – which is essentially creating a job for oneself – is to be an entrepreneur. Rather than choosing the pattern of, ‘I work, I get paid, I work, I get paid’, an entrepreneur opts for a pattern of, ‘I work, I work, I work and I may get a much larger and more significant reward later’. This requires living life from the viewpoint of higher purpose, of being willing to expand the reality for many in the world, not just for their own personal gain. Unlike the regular worker, an entrepreneur’s income is independent of time invested. This means they are no longer limited by the boundaries of time equals money. As a result, the amount of money they could potentially make is infinite. Importantly, effective entrepreneurs and the wealthy have an authentic conception of the fact that true wealth is more than just money and commodities, it’s time and freedom.

Only the central bank has the power to legally print money. So, if you want to be on top of the food chain, you have to create jobs and opportunities for others too. You have to be the lion that hunts to feed the whole pride. In this way, an entrepreneur achieves their objectives in life while also providing for others. If your goal is to be a billionaire, you have to be willing to make other people millionaires.

How an effective entrepreneur relates to money

The Oxford English Dictionary defines the word ‘entrepreneur’ as ‘a person who makes money by starting or running businesses, especially when this involves taking financial risks’. However, being an entrepreneur goes far beyond that. First and foremost, an entrepreneur is aware and compassionate enough to be present to a deep pain point or problem affecting a significant number of beings in need, aka ‘the market’. The entrepreneur sees and validates the market’s pain with discernment and vision. This requires awareness, presence and authenticity, because unless the entrepreneur is aware of, present to and authentic about the pain of the market, they may end up building a solution for a problem that doesn’t exist, wasting significant resources, including people’s time and capital, in the process. An effective entrepreneur does not expect to be paid for their time. Once the pain of the market is authentically validated, he/she comes up with a solution by arranging and leading a team of people to deliver the solution, paying them for their services as employees or external service providers. This requires the entrepreneur to be visionary and live life from the viewpoint of higher purpose. Below is an excerpt from my book, BEING, on the quality of higher purpose in relation to delayed gratification and the entrepreneurial mindset.

So the Meaning that higher purpose refers to is twofold. Firstly it is about being visionary. It’s about having the vision to see what lies ahead, to predict the future, making it strongly linked to awareness and freedom. Secondly, it’s about having the willingness, patience, courage and foresight to delay rewards or gratification and take the associated risk, to go beyond your immediate interests, needs, wants and temptations for the purpose of achieving something more worthwhile and meaningful that brings far greater and broader-reaching rewards.

An effective entrepreneur sees a problem, comes up with solutions, generates jobs and pays people before he/she expects to be rewarded. They are prepared for delayed gratification. The entrepreneur has to believe before seeing, while most people are accustomed to seeing first and then believing. This requires courage, empowerment, resourcefulness, persistence, perseverance and many other qualities not possessed to a high degree by most people. We need entrepreneurs to solve problems, save our time, make life more comfortable, easy and enjoyable, generate jobs and, of course, pay the taxes.

Effective entrepreneurs channel a far more abundant mindset about money than most people do; this is how they relate to money. Not only do they know how to serve and generate cash flow, but they also know there are plenty of people in the world who are desperately seeking quality opportunities to invest their money into. Those investors understand that money, as a commodity, will depreciate unless it is invested, as mentioned earlier. They include high net worth individuals, venture capitalists and even astute family members and friends. The entrepreneur knows that raising funds from investors or getting a loan is always an option. And they enjoy being generous, paying others before themselves and reinvesting money generated into the business to push the boundaries and their invention forward. Furthermore, the true entrepreneur, like a bird, knows they can rely on their wings if the branch they are standing on breaks.

What’s stopping you from generating wealth?

When you understand that people and systems control our money and that our currency is like a ruler on which each metric of measure changes daily, you will begin to appreciate the need to be realistic about money if you wish to generate wealth. While you may not be able to influence the whole economy, you can choose to legitimately serve others and enjoy the adventure of building your business and serving the genuine needs of others, which is what true entrepreneurs and investors do. This requires a paradigm shift around the way you perceive and conceive money. If your conception of money is not aligned with reality and you don't understand the need to convert your currency into assets, you will become poorer and poorer, even if you generate more revenue and grow your business. If you want to be an entrepreneur and create sustainable wealth, the goal is to generate more revenue and income while managing your expenditure and gradually converting your liquid cash into tangible assets. There is an art and science to this that requires the ability and willingness to manage risk. There is also an element of ‘luck management’ involved in effectively converting cash into assets, a subject worthy of examination in a future article.

In addition to requiring a paradigm shift around the way you perceive and conceive money, becoming an entrepreneur and investor also requires you to work on your Being. An effective entrepreneur requires many qualities such as awareness, authenticity, autonomy and responsibility, higher purpose, courage, persistence, proactivity, resourcefulness, resilience and so on. In my book, BEING, I introduce readers to a unique paradigm called the Being Framework, which I created following extensive studies of the world’s highest-achieving entrepreneurs and leaders. The framework articulates the thirty-one qualities that matter most for a human being to live a life of effectiveness, high performance and fulfilment, particularly in the commercial realm.

Last, but not least, to be an effective entrepreneur demands a solid understanding of the techniques and skills required to build and scale a business concept. Not only does the concept need to authentically address a burning pain in the market, but it also needs to be so polished and clearly articulated that investors will want to invest their capital into it. These skills and techniques are addressed in the Genesis Framework™, a program run through my company, Engenesis, and another book I am working on.

Conclusion

We all have our own ‘Web of Perceptions’ in terms of the way we perceive and conceive matters in life, and money is no exception. The wealthy, high achievers, leaders and entrepreneurs relate to money and capital not only in a different way from most people in society but in a far more accurate and congruent manner in terms of what money is and how it works. We pay a huge price when we hold invalid perceptions, whether individually or collectively. Effective high performers rarely pay that price; they know the value of being aligned with reality and how important it is to value awareness. That’s why they constantly invest in true education to further their knowledge and wisdom, continually polishing the areas they need to work on and transforming, which ultimately reflects in the results they produce, for example, greater wealth. Money/capital is abundant; it’s all around us and readily accessible for people whose perception of money is congruent with reality.

To discover and explore all the qualities that are critical for entrepreneurship and leadership, purchase a copy of my book, BEING.